Nowadays, many well-earning developers wonder whether or not investing in stocks is worth all the hassle.

Unfortunately, at the same time, most software developers still don’t know much about finance and investment in general, and the stock market specifically.

Even the developers, who joined early-stage start-ups or big tech companies and got proper compensation in stocks, don’t know how it will benefit them in the future.

When I started being interested in investment opportunities, I was terrified and intimated. I thought that this is only for financial experts and already wealthy people.

I was so wrong!

Of course, you should educate yourself first before you dive too deep into investing, but in reality, it’s not that hard as you think it is.

Especially if you begin with investing in the stock market.

💰 Stocks increasing your capital

Investing in stock is not gambling.

If you can save regularly and invest wisely over a long time, you can grow your capital enormously.

However, you shouldn’t invest if you are financially broke. Make sure before that your financial situation is in great shape, that you have an emergency fund to cover around three months of expenses in case of any emergency.

It can also be useful to learn how to free extra monthly cash from your dev-salary for investment, so you can spend less and invest more. For that, you can use my top-15 tips cheat sheet to save more cash monthly here.

Investing is very interesting, despite the capital growth, that gives you something intelligent to learn rather than playing video games or watching TV shows.

Most investors find long-term investments always beneficial for their capital.

For example, investing in high-growth new-on-the-market stocks may seem and certainly can be a great way to build wealth. Despite that, it’s wise to make an investment portfolio with the shares of established and grown companies.

“It is not necessary to do extraordinary things to get extraordinary results.”—Warren Buffett

The most convenient and unmistakable approach to growth capital in the stock market is to buy company shares with great businesses for reasonable prices; hold them as long as they remain doing great businesses.

Another impressive thing about stock investment, that your investment assets are liquid. You can sell them anytime and get your money back to your bank account.

📈 Stocks growing historically

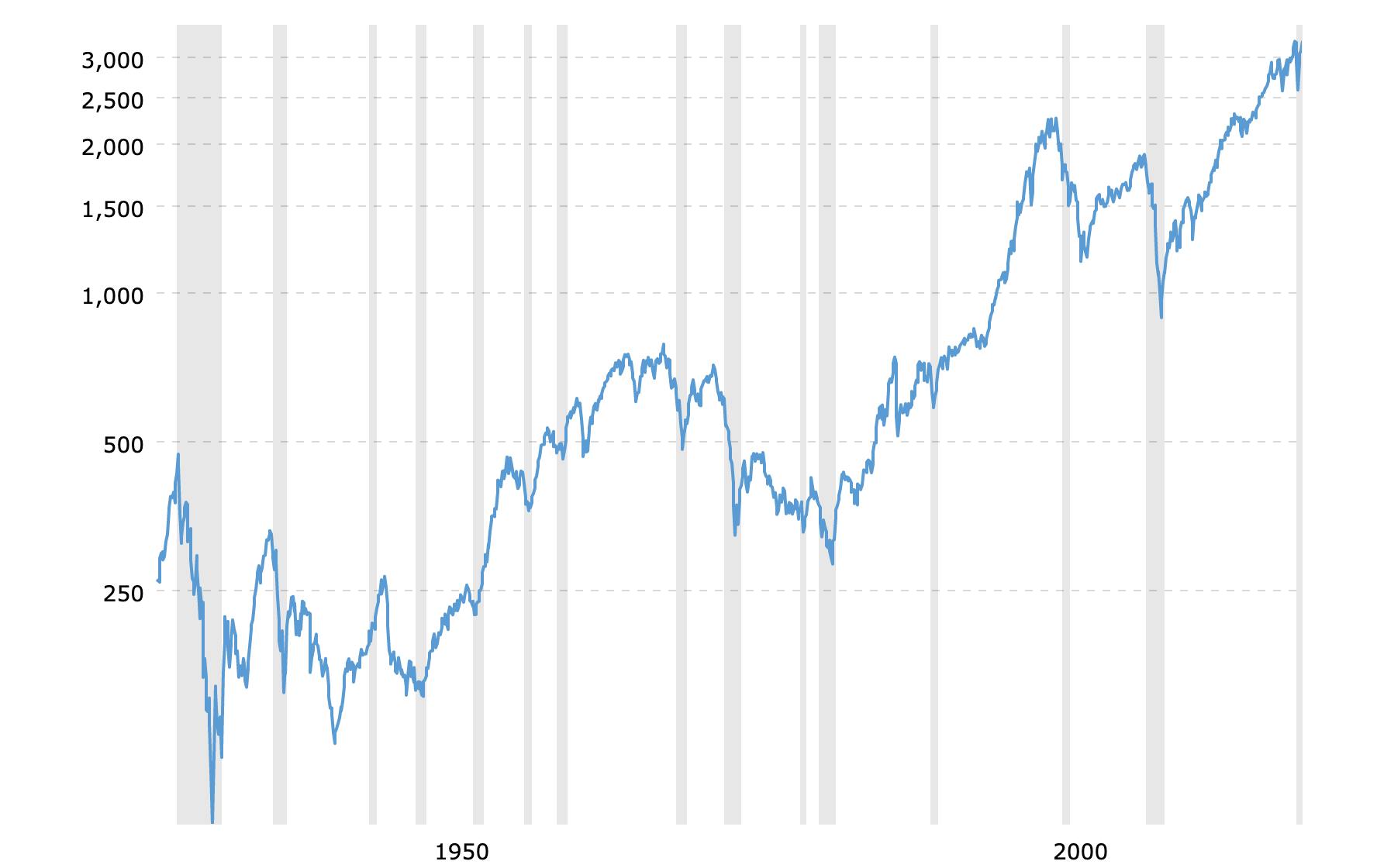

It’s not a secret that there are bad and good times for stock investment.

This year, there was a stock market crash and have been market crashes, pullbacks, and periods of lousy performance before, and they will be in the market later in the future.

And still, the US S&P 500 has historically produced 10%-11% before inflation or 7%-8% after inflation, and you can easily access it through your online broker or bank account.

Overall, stocks tend to rise over the last 80-100 years! S&P 500 Index - 90 Year Historical Chart:

Historically, small-cap investing has proved to be much more beneficial than in large caps. Some small-cap companies can become large and highly profitable companies in the long run, like in 10-20 years (along with the digitalization and tech startups, it can take even 5 years).

So if you decide to buy such stocks and hold them for a specific period, you might make a lot of money at the end after selling them or by keeping to collect dividends from them so far as the company decided to pay them off.

Tip: find and research around 100 small-cap companies; filter them down to the best 5-10, and decide to invest in the absolute 3-5 favorites out of these, based on your conviction and analysis.

💎 Stocks keeping investment value

You want the values of your stocks to increase because this is how your invested capital grows.

Value investing means focusing on companies that can grow and become great first.

The underlying value investing concept is quite straightforward:

You know the true value of the company stocks

You buy it on sale

You save a lot of money in this case

You hold it and benefit from it

Indeed, stock prices can change, for example, when the market is volatile, even when the actual company stock value has remained the same.

Because depending on the market and its demand, stocks go through higher and lower periods that lead to substantial price fluctuations.

But that doesn’t change the fact that you are getting for your money.

As an investor, you are willing to buy stock shares at that “discount” compared to how the market values them. So in return for buying and then holding these value stock shares for the long-term, you can be rewarded handsomely.

Learn more about finance and investment from my top-10 book list!

💸 Stocks paying off dividends

By definition, dividends are part of the company profit that generally pays to equity shareholders. Usually, dividends are a reasonable percentage of company earnings.

Often large companies pay more dividend than smaller.

Logically, stocks that pay dividends regularly are the ones that should be in your investment portfolio. It means that dividend-paying stocks are cash-rich—they have consistent cash flows and are not debt-ridden according to their quarterly and yearly financial statements.

Moreover, the dividend history of stock can play a vital role in making rational decisions. That will help you understand whether the company pays dividends consistently and correctly for the last years.

If a stock growth slows, a dividend is another way to ensure income. Because dividend-paying companies are typically more established, prominent, and stable.

% Stocks compounding

Technically, company stocks offer no guarantee of income because their returns are based on market price volatility; moreover, they don’t really suppose to pay interest.

And still, there are two working ways on how the individual stock value of a particular company can rise along compounding your investments:

The company makes more profits so that investors are willing to pay for shares. Hence, the stock price per share tends to increase year over year at a rate that resembles compound interest. That means if the stock price goes up, there will be fewer shares outstanding to buy, but the total company value is not going down, and likely continue going up in the future.

If the company started performing and earning well, the company might consider issuing dividends that will behave like compound interest on your investment. Many good stock investments pay 3-6% per year in dividends, so compounding means taking yielded cash dividends and reinvesting them in more shares.

The compound interest uses time as the most significant factor for growing your returns. As a result, compounding does work in the stock market only if you invest in the long term.

The idea is that the company you invest in makes or will make a profit and yield dividends to enable you to reinvest that profit into its business. Then, it is getting bigger and makes even more profit the following year. That is how the definition of compound interest works for stocks.

📊 Stocks diversifying your investment

Diversifying means investing across different stocks to mitigate loss risks.

“Don’t pull all eggs in one basket”—English Proverb

If you invest all your money in a single stock or depend on a particular sector or invest in specific assets, the chances are high that you might lose all your money if those stocks don’t perform well.

Reduce your risk when seeking returns.

To balance out the losses and continue to make money, you must diversify your investments in stocks and not only in them.

If you have an investment portfolio that is permanently diversified and regularly rebalanced, you will not have periods of high losses nor high gains. Instead, you will get more steady capital net growth over the long term.

The number of stocks you should hold linearly depends on the needs to meet your investment objectives and goals.

The Intelligent Investor, Benjamin Graham, said that the magic number is somewhere between 10 and 30. As opposed to Peter Lynch, the famous fund manager at Magellan Fund, who did hold around 1500 stock positions at one point in time.

Remember that diversified stock shares may have capital growth and pay regular cash dividends, which can be compounding and automatically reinvested.

Conclusion

If you are convinced and itching to start your investment journey soon, make sure you will take the time to learn about all the basics before putting your savings into the stock market.

It is crucial to keep an open mind, read different sources about stock investing, and get exposed to different investing opinions, either.

Buy stocks in companies that have a business you can understand.

Starting with a proven investment strategy for investing in the stock market for investor beginners is necessary.

The more you educate yourself, the better the investment decisions you will make that will coincide in the long run.

Still here? That’s amazing! Thank you so much for reading! If you are interested to learn more about your Developer-Investor Personality, you can try my quiz here.

And if you would like to invest more from your typical developer salary, check out my top-15 tips cheat sheet and save more cash monthly.

Build your best life, Ilona Dee Codes

Disclaimer: Author’s opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by IlonaCodes constitutes an investment recommendation, nor should any data or content published by IlonaCodes be relied upon for any investment activities.